You need to be able to pinpoint PPC performance to improve it. Comparing current performance to a previous period is a solid way to start.

In this blog post, I’m going to take you through one approach to PPC performance analysis, an approach derived from the combined knowledge of the DOM team — that is, from multiple perspectives, from years of experience, across numerous industries.

Comparing current performance to a previous period is frequently fruitful. To improve performance, you need to find out what’s working and what’s not. (Pardon the mucosal elision.) Then you can prune poor-performing elements and nurture flourishing ones.

Campaign-level Insights

Compare week-over-week performance by various metrics

Each metric shows a different nuance of account performance. Start with the basics: impressions, clicks, conversions, and cost. Then consider what more sophisticated metrics matter to your client or industry: CTR, Avg. CPC, Conv. rate, Cost/conv, or ROAS.

At DOM, we’re fans of frequent, straightforward communication. It’s one pillar of The DOM Difference™ that we deliver to our clients. We report weekly about campaign performance. So that’s why I’ve selected that time range to compare in this example. The wider you expand your range, the larger the trends you can identify, of course.

A PPC account is a multifaceted, ever-changing beast. With dozens of campaigns, hundreds of ad groups, and sometimes thousands of keywords in play, it’s a challenge to separate the signal from the noise.

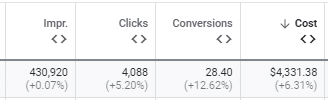

Once you apply your comparison dates, your stats will look like this, with the option to expand each metric (< >). The bold numbers are the regular values you’re used to seeing for each metric; they reflect the more recent of the periods you are comparing. The fainter figures in parentheses reflect the change in each stat from the earlier period to the more recent period. So here, there were 12% more conversions this week than the week before.

We are looking at account-wide performance totals and changes. This is necessary information to report, but it doesn’t mean much on its own. From the stats above, you could say that performance generally improved (with more conversions and clicks for a relatively slight increase in cost), but you wouldn’t be able to pinpoint why. We need to dig deeper.

Expand compared stats and sort for insights

Let’s look at changes in conversions.

We see here that the greatest change in conversions came in a campaign that went from 0 conversions last week to 3 conversions this week.

Note that I’ve sorted by absolute change, rather than change percentage. Looking at the percentage change for the whole account gives a clear picture of how overall performance changed. But that same metric often muddies things as you get more granular. As you can see, these top 3 campaigns all went from 0 conversions to more than 0 conversions, and thus their change percentage is recorded, rather unhelpfully, as the same for each (+?). Looking at percentage change is useful for metrics with high values; impressions, for instance, would be a better candidate for this kind of analysis.

So, we’ve identified that the campaign with the largest change during the comparison period is the campaign that went from 0 to 3 conversions, right? Not necessarily.

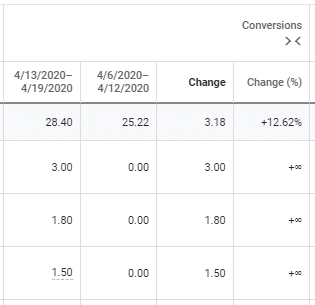

What the screenshot above shows is the largest positive change in conversions.

You also need to sort the change column to see the largest negative change.

Now we see that the greatest change in conversions is, in fact, the decline in conversions from 11 to 6.9.

Note that change percentage is also deceptive on the negative end. Indeed, any campaign that changes from having some conversions to not having any will show a change percentage of -100.00%. No matter how drastic the change — whether from 1 conversion to 0, or 17 to 0 — a change from something to nothing is calculated as -100.00%. That’s just how math works.

(With any analysis, it’s important to keep alert for sample bias. Check out a blog I wrote about sample bias here.)

Low hanging fruit

With just a few clicks to set up our comparison period and a few more to sort for change in conversion, we’ve identified the campaigns that have grown and declined the most.

We’ve now got two paths to follow to optimize our account. We can look into what’s going right and do more of it. And we look at the poor-performing campaigns and make changes that will hopefully improve performance; ultimately, if performance remains stagnant, we might consider pruning spend.

From here, I’m going to show you how to proceed down the negative rabbit hole. Reducing wasted spend is a tried-and-true method of streamlining PPC accounts. It is generally quick and requires little labor. You’re not reinventing the wheel; you’re just pausing things that aren’t performing and pulling back spend.

Ad Group-level Insights

Once you’ve identified a campaign that is struggling, dig deeper to the ad group level to see more precisely what part of the campaign isn’t performing.

Use a scalpel, not a sledgehammer.

Don’t just pause an entire campaign when a downturn in performance alarms you. Instead, zero in on ad groups and then keywords to trim away only what is necessary to reduce wasted spend. You don’t want to miss out on conversions by pausing keywords and ad groups too broadly.

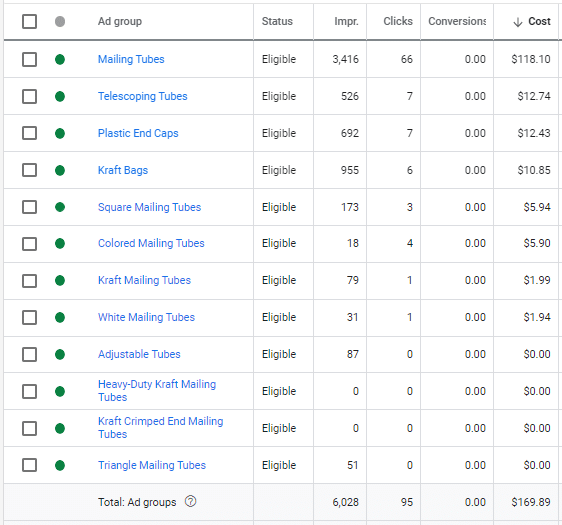

Take a look at the ad groups in this campaign for various kinds of mailing tubes.

This campaign is just a few days old and no ad group has converted yet, but already there is clearly one ad group that is running away with the spend. The Mailing Tubes ad group has spent the vast majority of the budget in this period, and, like the others, hasn’t converted. It’s time for some pruning.

Keyword-level Insights

An ailing ad group might not need to be excised in full; get to the bottom of things by examining the keywords. Then you can pause just the terms that aren’t performing while still running ads.

A Note on Ad Group & Keyword Organization

Structure your ad groups like this:

- Ad group name = Keyword phrase

- Keywords = 3 different match types (+modified +broad, “phrase,” [exact]) of the keyword phrase

This setup is a best practice at DOM. Organizationally, implementing this structure across accounts makes navigation easy and consistent for team members. And it aids performance analysis, as I shall now demonstrate below.

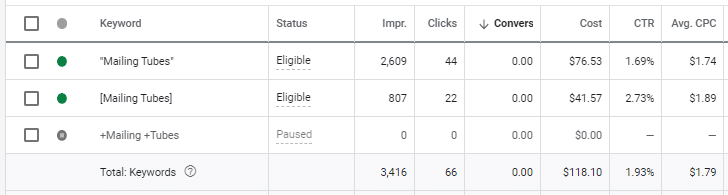

We saw above that the Mailing Tubes ad group has spent the most within this campaign. This is perhaps to be expected because Mailing Tubes is the most general way to describe the kinds of mailing products within this campaign.

In fact, I expected Mailing Tubes to be a bit too broad to run on, so I didn’t even enable the modified broad match keyword (+Mailing +Tubes) when I launched the campaign. And it’s a good thing I didn’t. As it is, the phrase match (“Mailing Tubes”) is spending nearly double the exact match ([Mailing Tubes]). So who knows how much the broad match would have spent.

We can see now that the phrase match keyword (“Mailing Tubes”) is responsible for nearly half of the total spend in this campaign (~$76 of ~$170). We can also see that the Mailing Tubes ad group is driving more than half of the impressions (~3,500 of ~6,000) and clicks (66 of 95) in this campaign.

So, I recommend we pause the phrase match (“Mailing Tubes”) and keep the exact match ([Mailing Tubes]) running. This way, we will disable the highest-spending element of this campaign, while still running on the keyword that is driving the most impressions and clicks.

Challenges

Now, of course, as days and weeks go on, just getting impressions and clicks isn’t going to cut it. If a month or two from now your campaign still doesn’t have any conversions, it’s time to consider more drastic action (unless your goal is awareness through impressions).

You may have to face some tough facts. You may not have the budget to compete for this keyword. Poor ad quality, landing page experience, and site speed may be hampering your ability to win auctions or excite users.

These are real challenges. And they are common. But because they are common, we at DOM have learned a thing or two about how to face these challenges.

How to Promote Growth After Pruning

Review search terms for new keyword opportunities

Remember, search terms are the other side of keywords. Keywords are what you, as an advertiser, bid to show an ad for; search terms are what users type into a search bar. An ad is then served to the user based on how relevant a keyword is to their search term (along with other factors). Search terms reveal what people are looking for. With this knowledge in hand, you can then craft more appealing keywords and ads.

Use broad match keyword variations to suss out long-tail keywords

When starting a campaign for a new product, we at DOM often begin with a generous assortment of keywords and variations that describe the product.

In the example with Mailing Tubes above, it might seem unwise to run on such a broad keyword as Mailing Tubes (and even more unwise to specifically run on the modified broad match variation +Mailing +Tubes). However, the insight into user intent that you can gain from search terms can be invaluable.

In casting a wide net for a few weeks or a few days keyword-wise, you are essentially getting a peek into people’s heads through their search terms. You are learning how people think about your product or similar products. So once again, you can then tailor your advertising to appeal to what people really want. It might even spark the opportunity to introduce new product lines altogether.

Limit spend on broad keywords, while still gathering user intent via search terms

If the approach that I’ve been laying out here makes sense for your business, you might even start thinking of running on broad keywords as an investment in each campaign. You might come to see the search terms as potent market research that is well-worth the expense. Manage this cost by running on them for a limited time at the start of the campaign or by placing them on a limited budget.

Here’s a quick overview of keyword strategy considering “branded” vs. “un-branded” keywords and selecting your “base” keyword phrase and then adding “modifiers” for additional keyword variations.

Refresh ad copy with search terms

Once you see how people describe the products they are looking for by examining their search terms, you can inject those terms into your ad copy. Do it in the first headline when you can. Wouldn’t you be more likely to click on an ad that spelled out exactly what you were thinking.

Test new landing pages

Perform A/B tests to see what appeals most to users. You might have one page that focuses on how your product is better on price than competitors. Another might tout your product’s durability and longevity. Another could show how your product saves the user time.

Landing pages have to close the deal. You’ve enticed a user with compelling ad copy, but your landing page has to move the user to take the action that you want them to.

Pursue SEO

If you have employed and optimized the PPC tactics described above, but still aren’t seeing the performance you would like, consider investing in SEO.

Search engine optimization encompasses an array of activities, from generating authoritative content, to garnering backlinks, to performing on-page optimization, to various species of user experience improvements. SEO is generally a longer-term endeavor than PPC. But there are things you can do that improve SEO and PPC simultaneously. Native landing pages, for instance.

If you direct PPC ads to landing pages that are a part of your website (that is, the landing pages are not hosted separately elsewhere on the web), then optimizing those landing pages is both a PPC and SEO play. In particular, improving native landing pages benefits your PPC efforts because landing page experience is one factor in your ad rank: the formula that Google uses to assign your position in an ad auction.

In short, the better your landing page experience, the less you’ll have to pay to show an ad.

From leaf to root. And back again.

In this blog post, I’ve taken you from a high-level view of account performance (conversions at the campaign level), down to a granular look at the keywords at the foundation (considering clicks and impressions). Then, I showed how studying search terms reveals user intent; these insights can be applied back up the chain in new keywords, tailored ads, better-organized ad groups, and split tests for landing pages.

In a nutshell:

- Compare performance to a previous period at the campaign level to illuminate growth and decline.

- Dig deeper to the ad groups and keywords that are the ultimate source of the change.

- Use a scalpel, not a sledgehammer, to trim away what’s not working.

- Structure your ad groups and keywords to aid analysis.

- Mine search terms to discover user intent.

- Inject search terms into ad copy.

- A/B test landing pages.

- Consider SEO to foster future growth.

For more on what DOM can do for your business, check out our PPC and SEO services pages.